Trade with Exness

Trade global markets with tight spreads, free education, and insights from experts.

Exness Account Types

Exness offers a wide range of account types to suit traders at all levels, with options varying in leverage, spreads, and minimum deposit requirements. This flexibility caters to diverse trading strategies and goals, ensuring there’s an account suitable for every trader, from beginners to experienced investors.

The account types offered by Exness are meticulously designed to enhance the trading experience, providing options such as the Standard Account for those who prefer simplicity and low entry barriers, and the Professional Accounts for experienced traders seeking more advanced features and competitive conditions. Each account type comes with its own set of benefits, including access to a wide range of financial instruments, various platforms like MetaTrader 4 and MetaTrader 5, and customized tools to empower traders in making informed decisions. By offering such a versatile portfolio of account options, Exness demonstrates its commitment to facilitating a supportive and flexible trading environment for its global clientele.

Types of Exness Accounts

Exness offers a variety of account types designed to cater to the diverse needs of traders, from beginners to experienced professionals. Here’s an overview of the primary account types available:

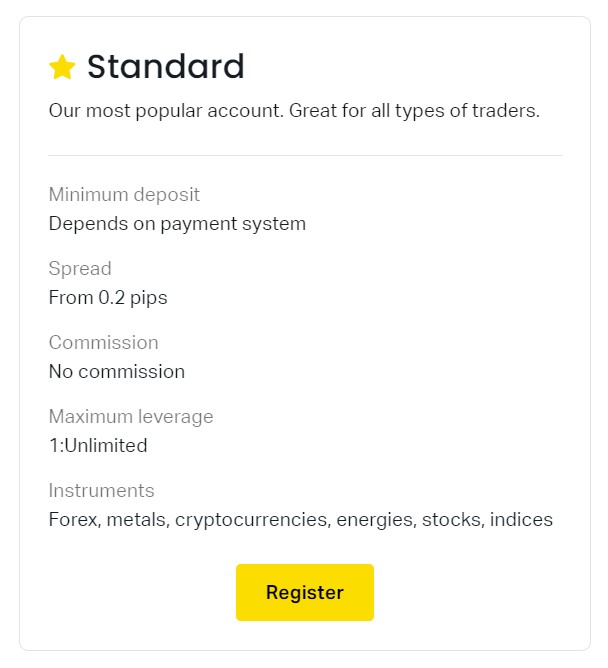

- Standard Accounts: Ideal for newcomers and those who prefer simplicity, the Standard Account is characterized by its ease of use, no minimum deposit requirement (in most cases), and relatively tight spreads.

- Standard Cent Accounts: Similar to the Standard Account but designed for micro trading, the Standard Cent Account allows traders to trade with smaller lot sizes.

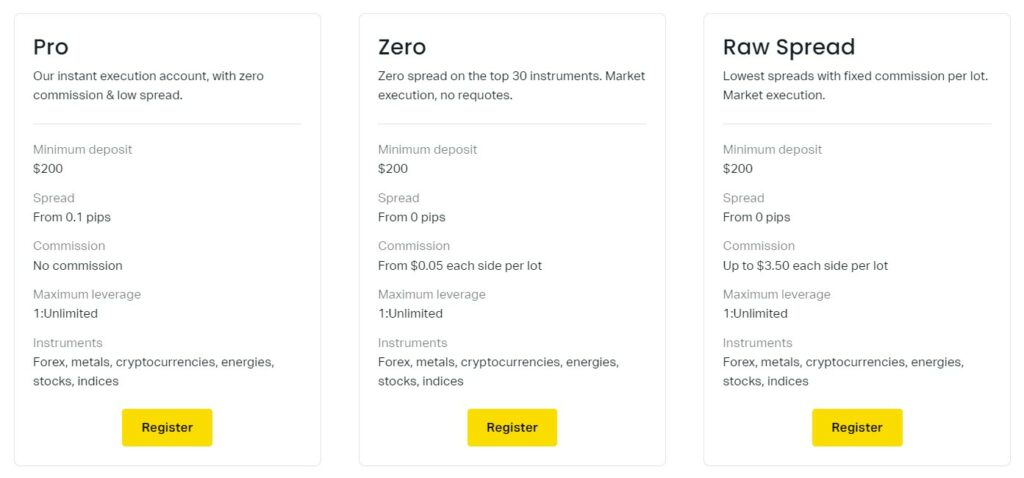

- Professional Accounts: Catering to the needs of experienced traders, Professional Accounts offer more competitive conditions, including lower spreads and higher leverage. This category includes several account types:

- Raw Spread Account: Offers raw spreads from 0.0 pips for a commission. It’s suitable for scalpers and traders using Expert Advisors (EAs) who require tight spreads to maximize their strategies.

- Zero Account: Features zero spreads for some instruments, with a commission charged. This account is favored by high-volume traders and those who prefer precision in quoting.

- Pro Account: Provides a balance between low spreads and no commission, designed for professional traders who need favorable conditions for high-volume trading.

- Demo Accounts: Exness also offers Demo Accounts for those looking to practice their trading strategies or get familiar with the trading platform without any financial risk.

- Islamic Accounts: Also known as swap-free accounts, these are tailored for traders who cannot pay or receive swaps or interest on overnight positions due to religious beliefs.

Choosing the Right Exness Account Type

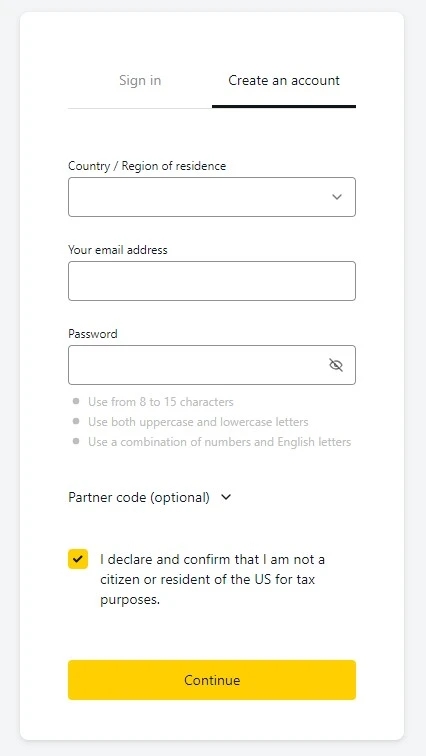

Choosing the right Exness account type is crucial for aligning with your trading strategy, experience level, and financial goals. Here’s how to navigate the options and select the best fit:

1. Assess Your Experience Level

- Beginners: If you’re new to forex trading, the Standard Account or Standard Cent Account could be ideal.

- Experienced Traders: For those with a solid understanding of forex markets and strategies, the Professional Accounts (Raw Spread, Zero, or Pro) might be more appropriate.

2. Consider Your Trading Strategy

- Scalping or High-Volume Trading: The Raw Spread Account or Zero Account is likely the best choice.

- General Trading: If your strategy doesn’t require the absolute lowest spreads and you prefer a balance between low costs and no commissions, the Pro Account might be the best fit.

3. Evaluate Your Financial Commitment

- Low Initial Deposit: The Standard and Standard Cent Accounts are great if you’re not ready to commit a large amount of capital.

- Higher Capital Investment: Professional Accounts might require a higher minimum deposit but offer advantages in spreads and leverage that can be beneficial for more serious trading investments.

4. Consider Special Requirements

- Swap-Free Trading: If your religious beliefs prohibit you from earning or paying interest, you can opt for an Islamic Account version of most account types, removing the swap fees on overnight positions.

- Practice Trading: Regardless of your experience level, if you want to test strategies in a risk-free environment, the Demo Account is invaluable.

Making Your Decision

After evaluating your needs based on the above criteria, you should have a clearer idea of which Exness account type aligns with your trading objectives. Remember, your choice is not set in stone; as you grow and your strategy evolves, you might find that switching to a different account type is necessary. Exness provides the flexibility to adapt your trading account to your changing needs.

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.

Trade Forex, Individual Stocks, Commodities, Precious Metals, Energies and Equity Indices at Exness.

Benefits of Exness Account Types

Exness’s diverse range of account types is designed to cater to the varying needs and preferences of traders, from beginners to seasoned professionals. Each account type comes with its unique set of benefits, ensuring that traders can select the option that best fits their trading style, experience level, and financial goals. Here’s a closer look at the benefits associated with different Exness account types:

Standard Accounts

- Ease of Use: Standard accounts are straightforward and easy to manage, making them ideal for beginners or those preferring simplicity in their trading operations.

- Lower Entry Requirements: With low minimum deposits, these accounts are accessible to a wide range of traders, allowing for easier entry into the forex market.

- Flexibility in Trading: They support a wide variety of trading strategies and are suitable for manual trading, automated trading systems, and the use of Expert Advisors (EAs).

Professional Accounts (Pro, Raw Spread, Zero, and ECN)

- Lower Costs: Professional accounts, particularly Raw Spread and Zero, offer lower spreads and commissions, which can significantly reduce trading costs for active traders and scalpers.

- Faster Execution: These accounts often come with market execution, ensuring faster trade execution speeds, which is crucial for high-frequency trading and strategies that rely on quick market entry and exit.

- Higher Leverage Options: Offering higher leverage, professional accounts enable traders to control larger positions with a smaller amount of capital, increasing potential returns (while also increasing risk).

Raw Spread and Zero Accounts

- Ultra-Low Spreads: Starting from 0.0 pips, these accounts are perfect for strategies that require tight spreads, such as scalping.

- Transparent Cost Structure: The commission-based pricing model provides clarity on trading costs, making it easier for traders to manage their trading expenses.

ECN Account

- Direct Market Access (DMA): ECN accounts offer direct access to the liquidity providers, ensuring the best possible spreads and execution speeds.

- Suitability for High Volume Traders: With its structure, the ECN account is ideal for traders executing large volumes, providing cost efficiencies at higher trading volumes.

Demo Account

- Risk-Free Environment: Allows traders to practice strategies and get familiar with the platform without any financial risk, using virtual funds.

- Real Market Conditions: Traders can experience real market conditions and use actual trading tools, making the transition to live trading smoother.

Islamic Account

- Swap-Free Trading: These accounts cater to traders who require an account that complies with Islamic finance principles, offering a swap-free option without interest charges on overnight positions.

Additional Benefits Across Account Types

- Access to Multiple Markets: All account types provide access to trade a wide range of instruments, including forex, cryptocurrencies, metals, and more.

- Advanced Trading Tools and Platforms: Traders can utilize advanced charting tools, analytical resources, and the MetaTrader platform for an enhanced trading experience.

- Support and Resources: Exness offers robust customer support, educational resources, and trading analytics to help traders make informed decisions.

Conclusion

Exness offers a comprehensive suite of account types designed to meet the diverse needs of traders at all levels of experience and with various trading strategies. From Standard and Standard Cent Accounts for beginners and those preferring low-risk environments, to Professional Accounts for experienced traders seeking competitive conditions, and even Islamic Accounts for those requiring swap-free trading, Exness caters to a broad audience within the trading community. The choice of the right account type is a crucial step towards aligning with your financial goals, trading strategy, and level of expertise.

FAQ for Exness Account Types

Can I have multiple account types at the same time?

Yes, Exness allows traders to have multiple accounts of different types. This versatility lets traders diversify their strategies and manage risk more effectively across different trading conditions.

Can I switch between account types after registration?

Yes, Exness allows you to switch between account types or open multiple accounts as your trading strategy or experience level changes. This flexibility ensures that your trading environment can adapt to your evolving needs.

How do I decide if a Standard Cent Account is right for me?

The Standard Cent Account is ideal if you’re new to trading or wish to trade with lower risk levels. It’s also useful for testing strategies in a live environment with minimal capital exposure.

Is there a minimum deposit required for opening an account?

The minimum deposit varies by account type. Standard Accounts often have no minimum deposit or very low requirements, making them accessible to a wide range of traders. Professional Accounts may require a higher minimum deposit, reflecting their more competitive trading conditions.

How do I choose the right account type for scalping or high-frequency trading?

For scalping or high-frequency trading, accounts with low spreads and fast execution are preferred. The Raw Spread and Zero Accounts are specifically designed for these strategies, offering low spreads and the option of commissions over spreads.

Refer a friend to earn 50$ each.