Trade with Exness

Trade global markets with tight spreads, free education, and insights from experts.

Exness Payment Methods

Exness offers a range of payment methods to accommodate the diverse needs and preferences of its clients globally. Whether you prefer traditional bank transfers, credit cards, or modern e-wallets, Exness has options to suit your financial management needs.

The availability of these payment options can vary by region due to local regulations and market conditions, but generally, Exness strives to provide a wide array of choices to ensure convenience and efficiency for its users. The following are some of the payment methods typically available through Exness:

- Bank Wire Transfers: A traditional and widely used method for depositing and withdrawing funds, allowing transactions directly from and to traders’ bank accounts.

- Credit and Debit Cards: Exness supports major credit and debit cards, including Visa, MasterCard, and others, for instant deposits and swift withdrawals.

- Electronic Wallets (e-Wallets): Digital wallets such as Neteller, Skrill, and WebMoney offer a quick and secure way to manage transactions without revealing bank account or card details.

- Local Payment Systems: Catering to specific geographic locations, Exness offers local payment methods that are popular in certain countries or regions, enhancing accessibility for users in those areas.

- Instant Bank Transfers: For some regions, Exness facilitates instant bank transfers, enabling users to quickly move funds between their trading account and bank account without the typical processing delay of traditional bank wires.

Supported Base Currencies with Exness

Exness offers traders a variety of base currencies depending on the type of trading account they choose. Standard accounts support the following currencies:

ARS, AED, AZN, AUD, BND, BHD, CHF, CAD, CNY, EUR, EGP, GHS, GBP, HUF, HKD, INR, IDR, JPY, JOD, KRW, KES, KWD, KZT, MXN, MAD, MYR, NZD, NGN, OMR, PKR, PHP, SAR, QAR, RHB, SGD, UAH, USD, UGX, UZS, XOF, VND, ZAR.

Traders need to carefully choose their base currency when setting up their account since this decision cannot be revised later. If funds are deposited in a different currency, there may be conversion charges involved. To effectively handle multiple base currencies, traders can open additional Exness trading accounts within the same Personal Area. This allows for strategic currency selection and helps minimize conversion fees.

How to Make a Payment Transaction in Exness

To make a payment transaction in Exness, follow these steps:

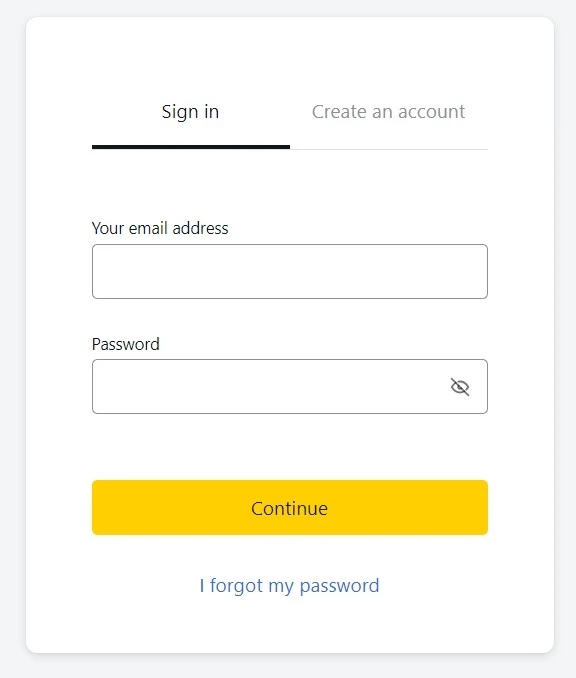

- Log in to your Exness account using your credentials.

- Navigate to the “Deposit” or “Withdrawal” section, depending on the transaction you wish to perform.

- Select your preferred payment method from the available options such as bank transfer, credit/debit card, or e-wallet.

- Enter the amount you wish to deposit or withdraw.

- Follow the on-screen instructions to complete the transaction securely.

- Verify the details of the transaction before finalizing it.

- Once the transaction is processed, you will receive a confirmation notification.

Remember to consider any associated fees and processing times for the chosen payment method. Exness strives to provide a seamless and secure payment experience for its users, ensuring that your funds are managed efficiently for your trading activities.

Fees and Charges of Exness

Exness is recognized for its transparent and competitive approach to fees and charges associated with its payment services. The platform endeavors to offer low-cost or even free transactions, making it an attractive option for traders and businesses alike. However, the specific fees and charges can vary depending on the payment method chosen, the currency involved, and the transaction’s geographic location. Here’s an overview of how Exness structures its fees and charges for payments:

- Deposits: Exness prides itself on offering free deposits across most payment methods. This means that traders can fund their accounts without incurring additional costs from the platform’s side. However, it’s essential to note that third-party fees may still apply, such as charges from banks or electronic payment systems.

- Withdrawals: Exness also strives to provide free withdrawals, reinforcing its trader-friendly fee structure. The platform covers processing fees for the first few withdrawals each month, depending on the payment method. After exceeding this limit, a nominal fee might be charged. Again, traders should be aware of potential third-party fees that could affect the overall cost of the transaction.

- Spread and Commission: While not directly related to payment processing, it’s worth noting that Exness generates revenue through spreads and commissions on trades, which are competitive in the industry. These costs vary by account type and market conditions.

- Conversion Fees: For transactions involving currency conversion, Exness offers competitive exchange rates. However, traders should expect to bear the costs associated with converting funds from one currency to another. These fees are typically embedded in the exchange rate provided.

- Inactivity Fees: Exness may charge an inactivity fee for accounts that remain dormant for an extended period. This fee is only applied after a specific duration of inactivity and is clearly communicated to users in advance.

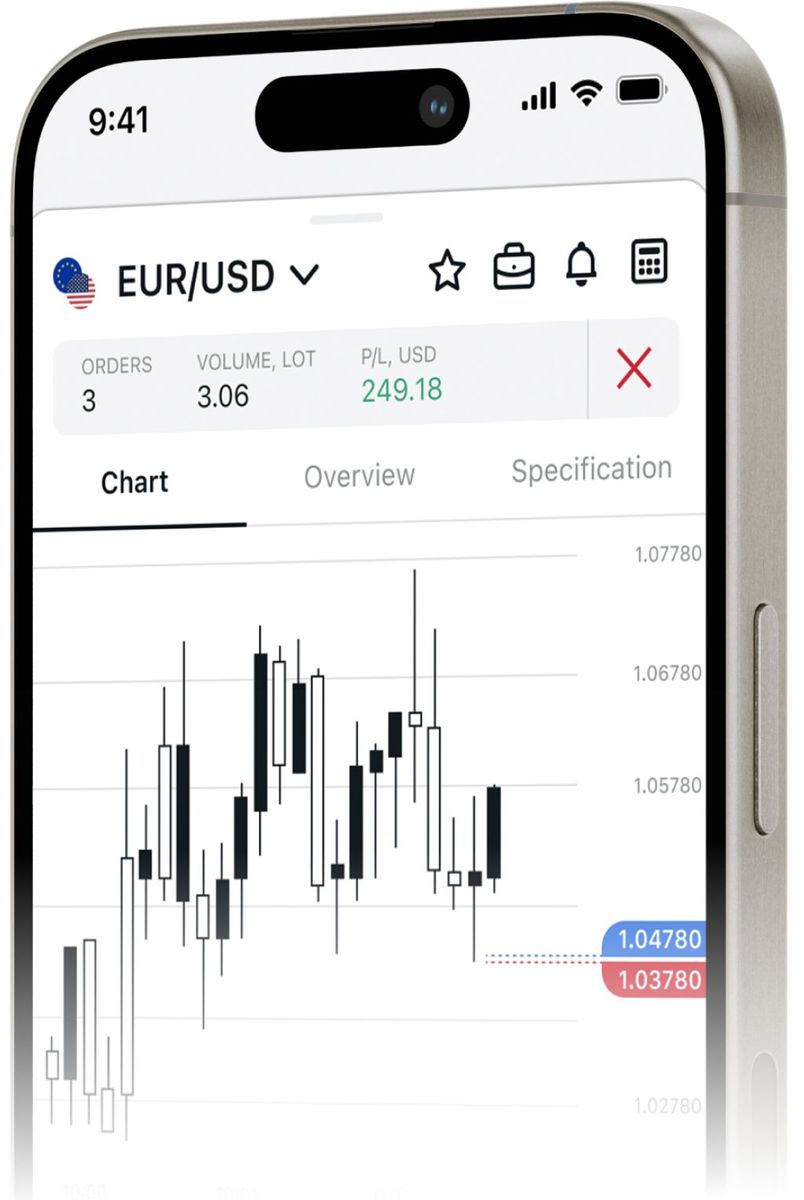

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.

Trade Forex, Individual Stocks, Commodities, Precious Metals, Energies and Equity Indices at Exness.

Benefits of Using Exness Payments

Exness offers a robust and user-friendly payment system designed to facilitate smooth and efficient financial transactions for its traders. This system encompasses deposits, withdrawals, and internal transfers, providing a comprehensive solution tailored to meet the diverse needs of the trading community. Here are the key benefits of using Exness payments:

1. Wide Range of Payment Methods

- Exness supports a variety of payment options, including bank wire transfers, credit/debit cards, and electronic payment systems like Neteller, Skrill, and WebMoney. This diversity ensures traders can choose the method that best suits their preferences and geographic location.

2. Instant Deposits and Withdrawals

- One of the standout features of Exness’s payment system is the capability for instant deposits and withdrawals, minimizing the waiting time for funds to appear in the trading account or bank account. This instant processing is crucial for traders who need quick access to their funds.

3. No Commission on Deposits and Withdrawals

- Exness does not charge any commission on deposits and withdrawals, making it more cost-effective for traders. This policy helps traders manage their finances more efficiently, without worrying about extra charges eating into their profits.

4. Secure Transactions

- The payment system employs advanced security measures, including encryption protocols, to ensure that all financial transactions are safe and secure. This protects traders’ funds and personal information from unauthorized access.

5. Multiple Currencies

- Exness allows traders to make transactions in various currencies, offering flexibility and reducing the need for currency conversions that might incur additional costs.

6. Easy Management

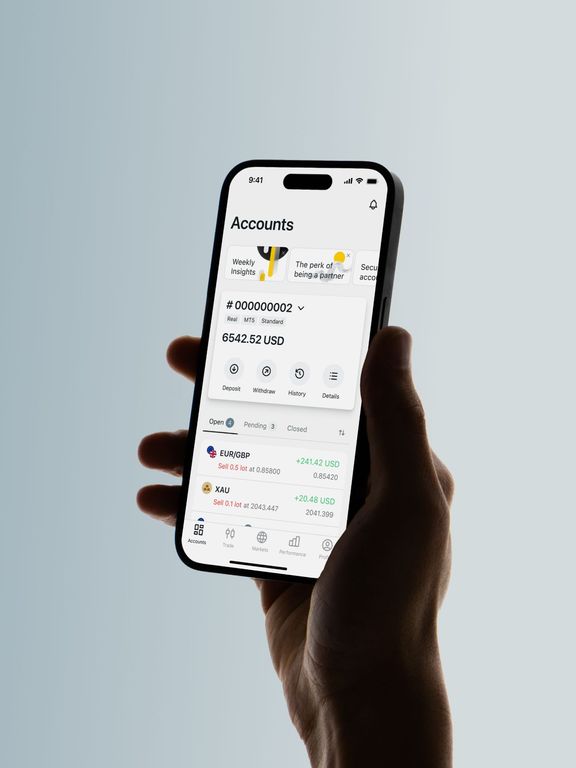

- The Exness Personal Area provides a straightforward and convenient interface for managing payments. Traders can easily make deposits, request withdrawals, and monitor their transaction history in one place.

7. Rapid Internal Transfers

- Traders can perform rapid internal transfers between their own trading accounts, facilitating efficient capital management and strategy implementation.

8. Automated Withdrawal System

- The automated withdrawal system speeds up the withdrawal process, allowing traders to access their funds without unnecessary delays.

Conclusion

Exness offers a commendable array of payment methods, ideal for the trading community. Rooted in Exness’ robust online trading foundation, these methods ensure secure, efficient, and versatile transactions. From traditional bank wires and credit cards to modern e-wallets, Exness caters to a global audience with varied preferences. Their strategic approach to minimizing fees reflects an understanding of trader and business needs, enhancing competitiveness. With a focus on innovation and user-friendly fee policies, Exness sets industry standards in financial services. Whether for individual traders or businesses seeking reliable payment solutions, Exness’ methods promise convenience, innovation, and trust, making them a top choice in the market.

FAQ for Exness Payments

What payment methods are available on Exness?

Exness Payments offers a wide range of payment methods including bank wire transfers, credit/debit cards, electronic wallets (e-Wallets) like Neteller and Skrill, local payment systems specific to certain regions, and instant bank transfers.

Are there any fees for depositing or withdrawing funds from Exness?

Exness strives to provide free deposits and withdrawals for most payment methods. However, traders should be aware of potential third-party fees from banks or electronic payment systems. Some withdrawal methods may incur nominal fees after exceeding a certain number of free withdrawals per month.

How long do transactions take with Exness?

Transaction times can vary depending on the payment method. Instant deposits are available with methods like credit cards and e-Wallets, while bank transfers may take longer. Withdrawal processing times are also efficient, with many transactions being processed within 24 hours.

Is my financial information safe with Exness?

Yes, Exness Payments employs advanced encryption and cybersecurity measures to protect users’ financial information and transactions from unauthorized access and potential threats.

Can I use multiple payment methods with Exness?

Yes, users can utilize multiple payment methods to fund their accounts. However, it’s important to note that withdrawals must be made using the same method as the deposit whenever possible, as part of anti-money laundering policies.

Refer a friend to earn 50$ each.